Music tech investment in 2013

Mr. Karim Fanous, Head of Research at Music Ally, blogs about music tech investment in 2013 and looks ahead to 2014.

In this post we’ll take a look at music tech investment trends in 2013 so far and explore what sustainability may mean to these companies. Specifically we’ll look at how much investment has been raised so far, which companies have raised that investment, how the different music technology sectors compare and finally where we think the investment action is in 2014 and what the trends will be.

We’ve scoured the Music Ally archives to aggregate all the major investments that we’ve reported and been aware of so far this year, and we’ve cross-referenced and added to this data using CrunchBase and Digital Music News’ 1H 2012/2013 investment round up.[1]

The investments we’ve included have been raised or declared after the beginning of this year and can be either first or additional rounds for a company. We’ve only included companies that have raised sums of US $500,000 or over. This is not to belittle the important funding that takes place below that level, but it is a much harder area to track comprehensively and deserves a separate look in its own right.

We can’t track absolutely every investment in music tech over $500,000 that’s taken place around the world so far this year, but what we can do is paint a picture of the topline trends and where the action is; moreso who the biggest players are in terms of raising investment and what the future in terms of investment looks like for them.

We’ve broken down the companies into arbitrary categories: artist tools and analytics, content companies, music creation and learning, music services, recommendation and recognition, social and video and live. In some categories – mostly social and video – we’ve included companies which aren’t pure music companies, but have a heavy use or influence in the music space, for example Urturn which has run many campaigns for the likes of One Direction, David Bowie and more but which is content agnostic and operates in other industries like fashion; and MCNs like Fullscreen which don’t focus solely on music content.

1. Disclosed investment

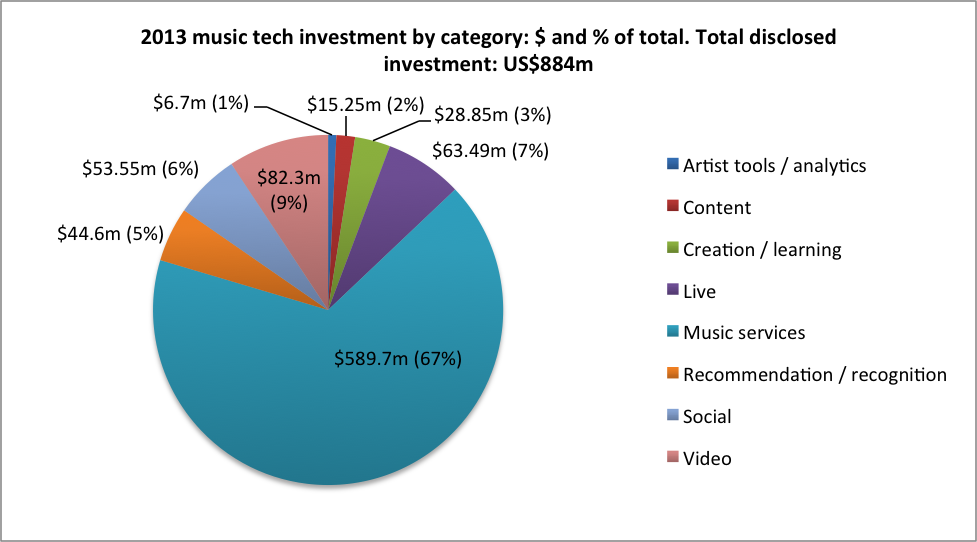

So, to the investment then: we’ve tracked a total of $884m of disclosed investments so far. By “disclosed” we mean they are the investments of which details of amounts are publicly available. The pie chart below breaks down category values and the percentage of total investment in each one.

Let’s review the categories, ranked in order of how much investment they took:

- Music services: the lion’s share of investment – 67% and $589.7m – has gone into the music service category, with only three companies making up a very large sum. Beats Music is the driver here, with a recent investment round of $500m announced in September and an earlier investment this year of $60m taking its total raised so far in 2013 to $560m. TuneIn Radio and Songza add smaller but significant investment at $25m and $4.7m respectively.

Previously investors have been weary of dealing with companies that require music licences, concerned that money invested will go straight towards licences and leave little for development and also that when rightholders see the investment they might raise their licensing demands come renewal time. However stakeholders and the music services themselves have realised that access models are here to stay and whoever controls music distribution in the future will reap rewards.

Cue a massive investment battle between leading players. Beats Music has raised a total of $560m, Spotify lies behind it with around $280m and is reportedly seeking another $200m and Deezer is also sitting on a pot of around $150m. Some of Beats’ money will go towards balancing its buy-out of HTC’s 24.84% stake at a hefty cost of around $265m. This would leave it on a par with Spotify’s investment, and Spotify would run ahead if it does then raise another $200m. Watch this space closely next year. These companies will no doubt try and increase their war chests and compete for dominance globally; while new mid and low tier models emerge underneath them. At the same time established giants Apple and Google will push their iTunes Radio and Google Play All Access services and there may be new entries from the likes of Amazon.

- Video: video is second with 9% of funding and $82.3m. Much of the action here is focused on YouTube. Startups spring up on top of major content platforms – either making use of the content in the platform or working in a B2B capacity with the platform and its users. Two years ago super-angel Ron Conway spoke of the huge potential for startups to build on top of the music platforms of big brands like Apple, Google, Amazon, Pandora and Spotify.[2] We’ve seen this happen with Spotify and Deezer’s app platforms and there is a clear concentration on YouTube and the opportunities that come with what many see as the world’s biggest music streaming platform – certainly in terms of its 1bn monthly active users.

The multi-channel networks (MCNs) lead the way this year in terms of investment with Fullscreen and Maker Studios taking $30m and $26m. However this is still a rocky area and we expect more lawsuits to come in the near future which might stifle the sector and make investment risky.[3] It’s also risky focusing a business model on top of one platform. We’ve seen Zynga and RootMusic stumble at the hands of slight changes in Facebook’s platform. However the opportunities are clear.

- Live: next comes live with 7% of the investment and $63.49m. Eventbrite, which has been used to sell tickets for festivals and music other events, props up this category with a $60m investment, while another ticketing company – Festicket – and content companies EvntLive (live streaming) and Lively (live content sales) come in with smaller investments. The ticketing space is saturated and it has proven hard for companies to work their way in among incumbents like Live Nation/Ticketmaster and startups Songkick, Crowdsurge and Ticketfly. Eventbrite has positioned itself very well as a self-service company which works across different industry verticals. We don’t expect to see many other new entrants in the ticketing area.

There has been a surge of interest and activity in live streaming and live content sales in the last few years. Look at LoveLive’s progress and companies like Lively and Halo experimenting with selling people live recordings during and just after the experience, or companies like Makelight Interactive in the UK trying to create crowd-sourced interactive experiences at gigs. We’ll see more small investments in this space, while startups try and replicate or add to the live experience in the digital sphere. But it’s early days. Take out Eventbrite and live would fall further down in the pecking order so far this year.

- Social: social comes next at 6% and $53.55m with significant investment into platforms including Urturn and Troy Carter’s Backplane – $12m and $13.4m respectively. Chirpify is trying to crack the hard nut of in-stream social commerce with $2m investment in a space which is not mature yet. Boutique social media agency theAudience takes the largest investment ($20m). Other platforms including Fanzy, Shots of Me and Listn take smaller amounts. There’ll be continuing bubbles of investment and new startups entering the space, but the opportunity is maturing and platforms like Shots Of Me and Listn may struggle to scale users and drop off down the line.

- Recommendation and recognition: this is an interesting area and adds 5% of investment so far with $44.6m. There’s been a big focus on this area in the last few years but we’ve seen a few startups come and go. However those that stick it out stand to fill gaps for bigger music services with large amounts of funding – consider Tunigo’s acquisition by Spotify this year. So there is still opportunity here. Leading the space is one of the music tech startup poster boys – Shazam, which took $40m in July this year to help fuel its expansion into Latin America.

- Creation and learning: this sector adds 3% of investment with $28.85m. We’re seeing lots of startups crop up in this area, take small-ish sums of investment, cause a buzz and then often fade away. This is especially the case with play-along and fun learning apps. We often see a splash into the space from a fun and buzzy app but it’s hard for the company behind it to repeat the trick and launch a new app that’s just as good and buzzy, or to keep people’s attention and users in the same app over a long period. Long-term success is the challenge for these companies.

Chromatik – a sheet music app – took $5.7m and is second biggest in the category. Sheet music is an interesting space and we’re seeing a lot of bubbles of activity and new apps spring up, while trying to nail down the rights to the sheet music itself. Music Mastermind took $11.4m – an unusually large sum – to put into its Zya music creation app. It was due for launch this summer but that’s been delayed, although it garnered pre-release praise at SXSW this year.

- Content: 2% and $15.25m is shared between two startups. Eyes are on Lyor Cohen’s new content company, 300, which took $5m although it’s unclear what shape it will take. Nevertheless it has an interesting investor in Google amongst others, which marks the trend of tech companies beginning to see themselves as content companies as well. Nettwerk Music Group took $10.25m to help fuel new and existing artist development.

We expect to see more investment in content production going forward, especially with tech companies like Google taking an interest in producing content themselves. This sector is also representative of bigger moves in the space and doesn’t contain every investment.

- Artist tools and analytics: finally artist tools and analytics saw 1% of the action with $6.7m dollars. Analytics platform Musicmetric took $4.7m and Artist Growth took $2m for its artist tools suite. We’re already seeing consolidation in the music industry analytics space with Musicmetric and Next Big Sound leading the way with mature offerings and not many other new entrants.

The artist tools space is a troublesome area and slightly stagnant in terms of development for now. The first generation of D2C content sales platforms and self serve marketing and distribution tools – for example Topspin Media, Bandcamp and CD Baby – have been established for a while and we expect to see an evolution soon with new platforms seeking to provide more artist needs under one roof. That means not just sales and marketing but other services like legal (contract templates or legal consultation for example), YouTube revenue optimisation, publishing, sync, artist management tools and other logistics services too.

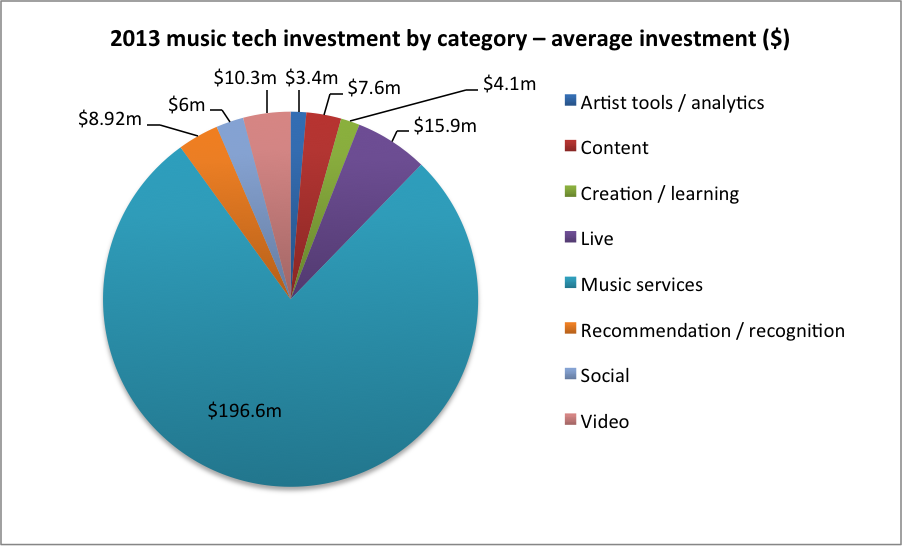

2. Average investment

Looking at the value of an average investment in each category, as expected the music services sector takes the largest average investment at $196.6 (driven by Beats), followed by live at $15.9m (driven by Eventbrite) and video third at $10.3m, driven by the MCNs.

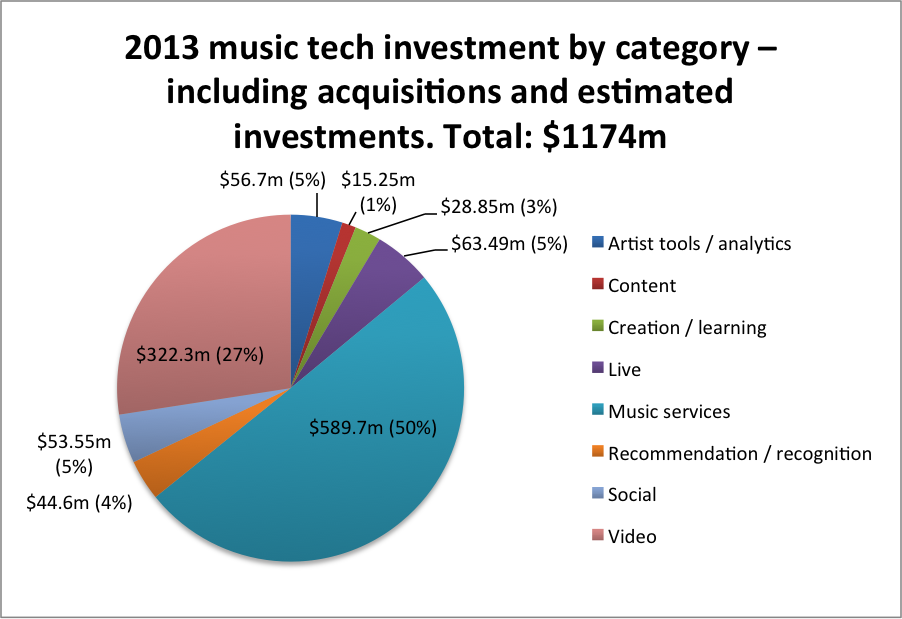

3. Investment plus acquisitions and undisclosed equity stakes

If we add acquisitions as well as undisclosed equity stakes which we can approximate the value of as well as the disclosed investments above, the picture changes dramatically. Video’s share of the action rises considerably to 27% and the total value of investment for far this year reaches $1.1bn dollars.

In July Vevo renewed its deal with YouTube and took an estimated $40m investment from YouTube in return for around 7% equity. Dwarfing this was Japanese e-commerce giant Rakuten’s $200m acquisition of online video streaming platform Viki. This makes music services and video the runaway leaders in the investment/acquisitions space with 50% and 27% of the value of the sector respectively. It also indicates the current value of content platforms to companies and investors, and the control over content distribution and the subsequent monetisation of the platform that comes with them.

The artist tools and analytics category also grows with SFX Entertainment’s estimated $50m acquisition of electronic music distributor Beatport in February this year.

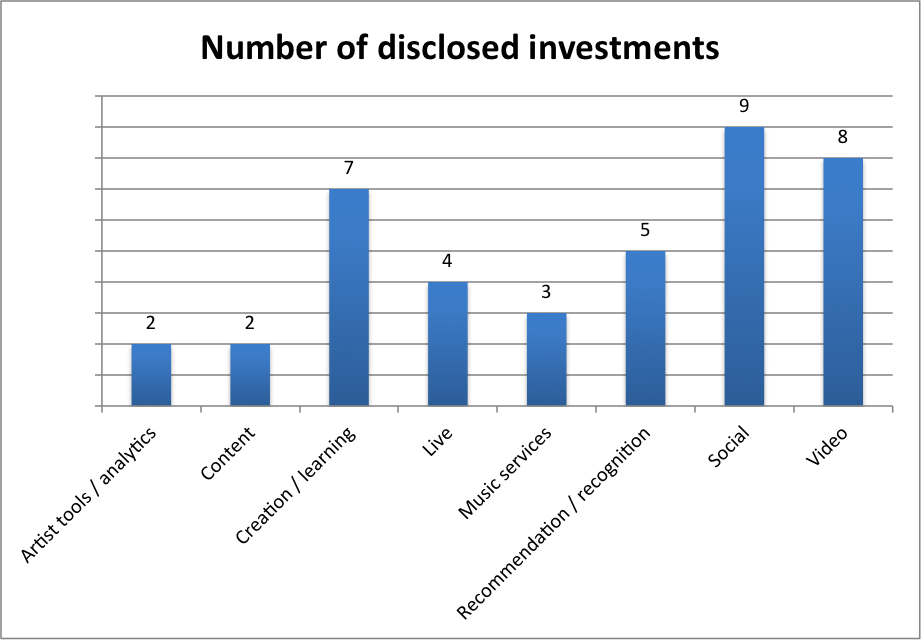

4. Number of investments

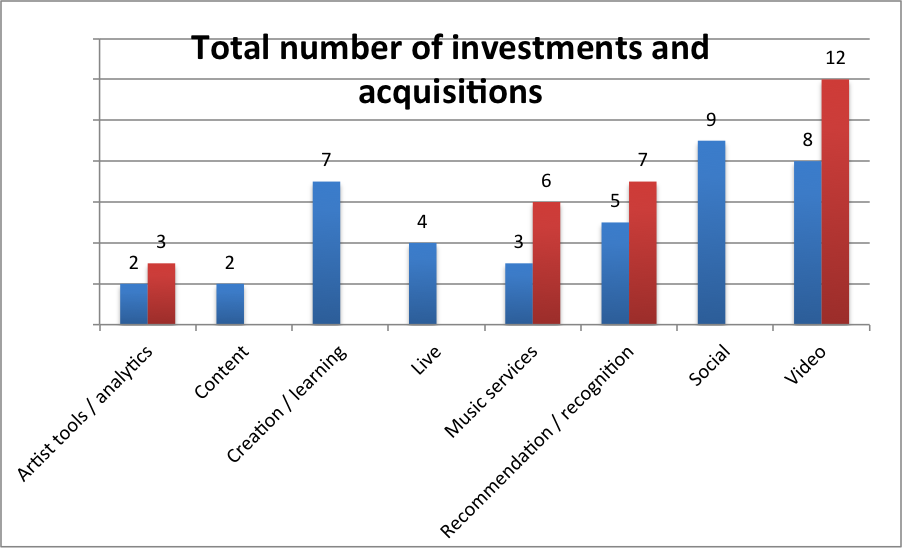

The highest volume of investments are in the video and social categories, followed by creation and learning. All of these categories take small-ish investments compared to the music services category which is the dominant sector with only three disclosed investments this year.

However if we factor in acquisitions and investments that we don’t know the value of it changes the picture slightly with video surging ahead of social and recommendation and recognition in numbers and music services creeping up the ladder. This emphasises the clear interest in the video space for investors and startups alike.

The list of extra investments and equity stakes are included in this chart are:

- Music services

- Cumulus Media’s partnership with Rdio

- ColumbusNova’s investment into Rhapsody

- Recommendation and recognition

- Twitter’s acquisition of WeAreHunted

- Spotify’s acquisition of Tunigo

- Video

- Miroma’s investment into SBTV

- LoveLive’s acquisition of Show Cobra

- Rakuten’s acquisition of Viki

- YouTube’s stake in Vevo

- Artist tools

- SFX’s acquisition of Beatport

5. Sustainability

What makes a startup sustainable? We’re not going to attempt to answer that question concretely. But we will offer some viewpoints. Most would say that sustainability means profitability, but considering some startups operate for many years without making a profit – Amazon took around six years to turn its first profit – there is another question which might inform the roadmap for startups in the near term: acquisition or IPO?

If the former a startup can look to fill a whole or basic need in a bigger business, or to scale users as quickly as possible in order to provide a large monetisable user base. Tunigo’s acquisition by Spotify is a good example of this sort of dynamic – providing Spotify with a contextual playlist and recommendation platform. SoundCloud has 250m monthly active users and would bring them with it to a parent company on acquisition. Viki created technology and a user base that Rakuten valued highly.

On the other hand an IPO keeps a company independent while offering a chance to raise more revenue and capitalise on its potential in the eyes of shareholders. However it changes the game for a startup, making it accountable to shareholders and its financial results even more scrutinised. Pandora was founded in 2000 and 13 years later it still isn’t profitable. It filed for IPO in 2011 and was valued at $2.6bn raising another $235m in the process. Net losses grew in Q2 2013 year-on-year 43.8% to $7.8m but it claimed a key inflection point in its development: mobile revenues increased to $116m. Pandora sees this revenue stream as its future. So after 13 years and an IPO it has kept going despite still making a loss, is still evolving in search of what will make its business profitable – and may be just on the cusp of discovering it. However the longer it takes the stiffer competition it will face from iTunes Radio.

6. Sustainability in streaming

For startups, especially music services, there is a delicate balance between cost of sales (licences), growth and development, and whether this leads to a loss or not. Glenn Peoples at Billboard was astute to point out earlier this year that the recent decrease in Spotify’s cost of sales as a percentage of revenue indicates that its model may be sustainable in the future.

Examining Spotify’s 2012 financials he pointed out that despite net loss increasing Spotify’s cost of sales fell to 83.5% of revenue in 2012 from 97.7% in 2011. This means that Spotify is generating more revenue and being more efficient with that revenue, keeping more of every dollar to cover corporate expenses.[4] Factor in that Spotify is in a long-term drive to scale while competing aggressively with other companies in a space that is nowhere near consumer maturity it makes sense that it should entertain heavy losses as long as it is expanding its footprint and user base and as long as it keeps lowering its cost of sales as a percentage of revenue.

Data source: PrivCo[5]

So focusing on cost of goods sold versus revenue does suggest that Spotify could be on a trajectory towards sustainability.[6]

7. Music tech investment trends in 2014

These are the investment trends, currents and opportunities we see around the corner in 2014.

The fight to control streaming music: as we’ve noted above the big streaming players are consolidating their war chests and have identified the importance of gaining a hold on music distribution over the next few years while consumers transition to access models. Expect some more investment and a big drive by all for user acquisition in the coming years.

Music as a utility: akin with the theme of startups building on top of content platforms, expect music and the services which distribute it to be more and more seen and used as a utility – whether YouTube, Spotify or others – and the building blocks and focal points of startup activity. However consider the aforementioned risks that come with that.

MCNs and optimising the return on video: YouTube has become an increasingly important revenue stream for rights owners and although the MCN space is a little bit grey with regards to stability and lawsuits, expect to see more action and investment in this area.

Investing in content: technology companies are increasingly investing in content and infrastructure to create content as they realise the importance of content to their platforms and being in control of it. For example YouTube has its YouTube Space creator spaces for people to use to make high-quality video and Google has also just invested in 300.

Filling gaps for bigger services and companies: startups will continue to look for and fill feature or service holes in bigger companies. The recommendation space has been busy in this regard with startups vying for the attention of bigger music services like Spotify; Tunigo’s acquisition a good example.

Artists and managers as investors: will.i.am grabbed attention in the recent Virgin Disruptors debate by saying, “‘I Gotta Feeling’ is still the number one downloaded song of all time in iTunes, but I made more money from the equity I own in Beats. That tells you hardware is the place.” At the same time when Troy Carter felt that it was unfair for third parties to control all the data and design of Lady Gaga’s social platforms he built Backplane – a white label social network. Artists and mangers themselves are increasingly turning their eye to technology investments, not only to reap financial rewards but also to accomplish things with technology by building it themselves. Having just split with Lady Gaga Troy Carter is raising up to $100m for startup investment and aside from founding Backplane has a number of investments including Songza above. At the same time Scooter Braun is launching a $120m investment fund. 2014 will be the year of artist managers and artists investing more heavily in technology.

Bridging the gap between artists and coders: coders have become invaluable allies to artists in creating technology platforms for great art and fan engagement and vice versa. Often the platforms become a part of the artistic experience (think ARTPOP or Biophilia). The two sides are increasingly working together and there are many initiatives globally to bring them together. Artists are beginning to understand that to innovate, catch attention and deliver their art in new, fun and beautiful ways they need to understand technology and find creative coders or technology companies to work with.

Crowdfunding startups for equity: until April 2012 in the US crowd-sourced funds were only allowed as donations or in exchange for rewards (for example a typical Kickstarter pledge for content, merchandise or experience). However in April 2012 the rules were changed and startups can now crowd-source funds in return for equity. This is a burgeoning area which we expect to see grow, driven by awareness of fundraising successes for technology projects on platforms like Kickstarter (think Pebble Smartwatch or Ouya open source games console) and the lure of equity and financial returns on investment.

Companies and brands as the new incubators: media companies and brands – for example Red Bull and the New York Times – are launching their own incubators for two key reasons: they realise that innovation in technology is a hot space and want to align their brands with it as well as place themselves on the cutting edge of technology trends, but also importantly want to stimulate the development of technology and new platforms that will help their own businesses.

Labels investing in startups: the Open EMI initiative signaled serious intent from labels to work with startups to reduce barriers to entry and ease the access of content. Could this go one step further in 2014 with labels seeking equity in hot startups when they crop up, or launching their own incubators? Consider that the major labels and independents (via Merlin) already have equity in Spotify.

Bringing all artist needs under one roof: we see an opportunity for “second generation” artist service startups to bring all artist needs under one roof. This doesn’t mean content sales and marketing tools only, it means combing these with artist administration tools and other services like providing legal document templates and consultations, sync tools, YouTube revenue optimisation tools and more.

Social commerce: monetising social platform content streams or media directly on social platforms is a nut that hasn’t been cracked yet, with social sitting more on the “intent” side of the route to purchase than on the “decision to purchase” side. Expect to see a lot of innovation in this area in the coming years.

8. Appendix: list of disclosed investments from 1.1.13 to 7.11.13

| Name | 2013 investment ($m) | Total funding | Category |

| Artist Growth | 2 | 2 | Artist tools / analytics |

| Musicmetric | 4.7 | 5.36 | Artist tools / analytics |

| Total this year (Artist tools / analytics) | 6.7 | ||

| Thee hundred (300) | 5 | 5 | Content |

| Nettwerk Music Group | 10.25 | 10.25 | Content |

| Total this year (content) | 15.25 | ||

| Chromatik | 5.7 | 7.7 | Creation / Learning |

| Edjing | 2.5 | 2.5 | Creation / Learning |

| JoyTunes | 1.5 | 2 | Creation / learning |

| Just Sing It | 1 | 1 | Creation / Learning |

| Splice | 2.75 | 2.75 | Creation / learning |

| TakeLessons | 4 | 12 | Creation / Learning |

| Zya | 11.4 | 30.1 | Creation / learning |

| Total (creation / learning) | 28.85 | ||

| Beats | 560 | 560 | Music service |

| Songza | 4.7 | 6.7 | Music service |

| TuneIn Radio | 25 | 47.5 | Music service |

| Total (music service) | 589.7 | ||

| Agogo | 1.5 | 1.5 | Recommendation / recognition |

| BioBeats | 0.65 | 0.65 | Recommendation / recognition |

| Shazam | 40 | 72 | Recommendation / recognition |

| TastemakerX | 1.25 | 3.05 | Recommendation / recognition |

| Tunesat | 1.2 | 8.2 | Recommendation / recognition |

| Total (recommendation / recognition) | 44.6 |

| Backplane | 12 | 17.8 | Social |

| Chirpify | 2 | 7.3 | Social |

| Listn | 0.5 | 0.5 | Social |

| Fanzy | 0.55 | 1.37 | Social |

| Shots Of Me | 1.1 | 1.1 | Social |

| Soundrop | 3.4 | 3.4 | Social |

| Tastebuds.fm | 0.6 | 0.6 | Social |

| theAudience | 20 | 20 | Social |

| Urturn | 13.4 | 13.4 | Social |

| Total (social) | 53.55 | ||

| Coub | 1 | 1 | Video |

| Interlude | 16 | 16 | Video |

| LoveLive | 2.7 | 2.7 | Video |

| Audiam | 0.5 | 0.5 | Video (YouTube) |

| DanceOn | 4 | 4 | Video (YouTube) |

| Fullscreen | 30 | 30 | Video (YouTube) |

| Maker Studios | 26 | 64.5 | Video (YouTube) |

| Patreon | 2.1 | 2.1 | Video (YouTube) |

| Total (video) | 82.3 |

Teksti: Karim Fanous – Head of Research, Music Ally

[1] http://www.crunchbase.com ; http://www.digitalmusicnews.com/permalink/2013/07/08/funding

[2] http://www.businessinsider.com/ron-conway-explains-why-digital-music-is-…

[3] http://musically.com/2013/08/07/music-publishers-sue-youtube-mcn-fullscr…

[4] http://www.billboard.com/biz/articles/news/digital-and-mobile/5337666/bu…

[5] http://www.privco.com/private-company/spotify-ltd

[6] Caveat: there was a recent wobble as Spotify’s UK revenues decreased year-on-year between 2011 and 2012, which Spotify blamed on accounting administration changes: global revenues for premium subscriptions were handled by Spotify UK for the first five months of 2011, but since June 2011 that revenue was recognised instead through its other local subsidiaries. This reflects the revenue decrease in the UK subsidiaries’ accounts. At the same time the UK subsidiary still posted a drop in cost of sales from £87.9m in 2011 to £76.2m in 2012, in line with the global drop. So accounting complications aside, the bigger global picture still suggests that there are shoots of sustainability in its bus. http://musically.com/2013/11/14/spotify-ltd-uk-financial-results/